It’s been nearly two years since that storied summer of ’21 when cryptocurrencies hit their all-time highs. Bitcoin (BTC) grabbed the bulk of headlines before topping out at just over $65,000 (US) for each of the digital tokens. And, almost immediately, it seemed like there was a rush of negative press attacking everything from the fundamental nature of cryptocurrency to the very moral character of anyone who might want to conduct business outside of the traditional banking structure. The most compelling arguments against Bitcoin, however, didn’t come from there — instead, they came from the environmentalists, who pointed out that the fossil fuels being used to generate the massive computing power needed to “crack” the complex mathematical cryptography that powers the blockchain behind Bitcoin were spitting out so many harmful carbon emissions that any other benefit that might come from the widespread implementation of the technology simply couldn’t tip the balance.

But that was then. And this, as they say, is now. It’s mid-March as we type this, and the world is reeling from the most serious string of US bank failures in nearly two decades. The rapid collapse of Silicon Valley Bank, in particular, brought fresh attention to the Bitcoin maximalist notion that the private banking industry may not have the best interests of its depositors at the heart of its decision-making process, and Bitcoin prices have surged accordingly. And, as the world’s attention re-focuses on the crypto world, it’s finding out that Bitcoin has gotten quite a bit “greener.”

The Big Green Elephant in the Room

It’s important to note that the environmental criticisms of Bitcoin were myopic, at best, and that even the most damning estimates of the energy consumed by mining1 Bitcoin — a University of Cambridge analysis estimated that bitcoin mining consumes 121.36 terawatt hours a year, or more energy than all of Argentina — failed to consider how much the conventional, fee-driven banking system was using total energy that Bitcoin sought to replace. In the case of traditional banks or the mining of gold, another traditional store of wealth often compared to Bitcoin, the energy used by the institutions was double the amount used by the Bitcoin miners.

However, reducing the energy footprint compared to traditional banks is not a compelling argument for the widespread adoption of Bitcoin. Still, understanding that, at its worst, this “new thing” that’s being criticized for its energy use is actually using half as much energy as another “existing thing” that is not being criticized for its energy use is a fine place to begin to address the changes that have taken place since BTC hit its all-time high.

For starters, the worst offenders — Chinese miners depending heavily on unregulated diesel-electric generators and coal-fired plants to run their computers2 — have been effectively shut down by the Chinese government’s crackdown on cryptocurrency. Next, with the price of bitcoin leveling off after a precipitous fall, it’s become more expensive to mine it, leading to increases in the energy efficiency of the computing machines that do the mining — and those efficiency gains can be impressive3 — but it’s the simple fact that Bitcoin requires as much energy as it does that has, perhaps counterintuitively, empowered the technology to drive “green” energy development to the benefit of everyone. And Bitcoin does this by creating demand for excess energy.

What’s excess energy? We’re glad you asked.

Solving the Problem of Free Energy

The problem is that solar panels generate lots of electricity in the middle of sunny days, frequently more than what’s required, driving down prices—sometimes even into negative territory.

— MIT Technology Review (@techreview) July 14, 2021

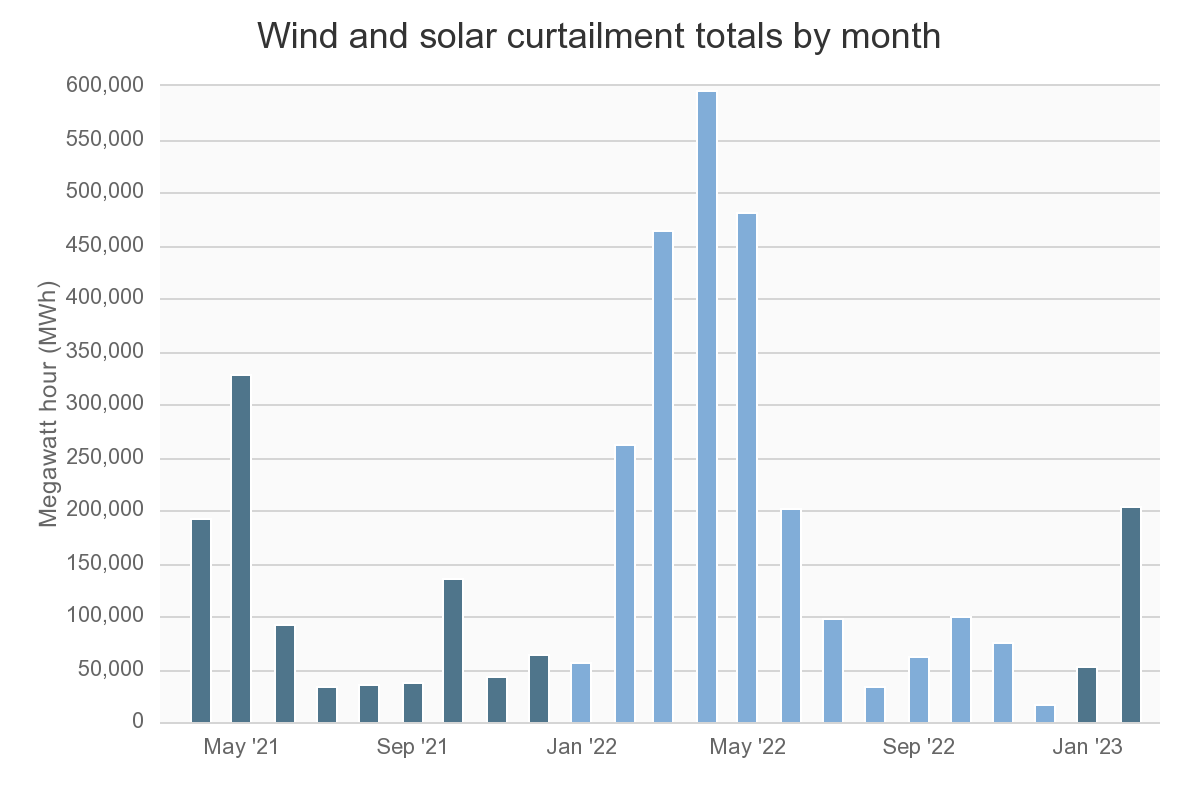

That’s right — the smart people at no less an institution than MIT are saying that too many solar panels can be a problem for the utility companies that generate and sell energy. If you’ve been following the narrative put forth by the people behind energy storage technology like the Tesla Powerwall or the Sunrun Brightbox, you already heard about how storing energy that’s available on off-peak hours for use during peak demand hours can save homeowners money and enhance the local energy grid, improving grid resilience and reducing the negative effects of heavy energy use during extreme heat days that can lead to rolling blackouts. That’s one way to put excess energy created on especially windy or sunny days to good use — but if there’s not enough storage to capture that excess capacity, the energy just “spills off,” or gets “curtailed,” driving down energy prices and increasing the time needed to get a positive ROI on solar investments.

It’s a strange problem to have: too much solar makes electricity so cheap that you never regain the costs of the solar panels Crypto mining solves that problem by creating a constant demand. And demand, as a consequence, sets a price.

“Solar and wind energy are intermittent4 because they only produce energy when the sun is shining and the wind is blowing. Much of this energy is generated when demand is low, and if this energy is not stored in batteries it is simply wasted or ‘curtailed,'” writes Dennis Porter, of CoinDesk. “Currently, the state of California is on track to curtail 5 million megawatt hours by 2030. This is more energy than the bottom 36 nations use combined. Bitcoin miners stand ready to purchase excess energy from wind and solar farms, improving the revenue for renewable generation and preventing taxpayers from subsidizing the generation of energy. A win-win.”

“Miners can also smooth out the intermittent generation of renewables by participating in grid-balancing services,” continues Porter. “Miners not only will consume excess generation from wind and solar generation, but also then reduce their energy consumption neary to zero when ratepayers and other key sectors, like hospitals and businesses, need power. Miners regularly reduce their consumption in states that allow this kind of grid participation, ensuring grid operators have the ability to keep the lights on and power prices low.

Generating demand for intermittent power that can’t be stored isn’t the only way crypto mining is helping pave the way for new sustainable energy technology, either. “In Pennsylvania in the early 1970s, Bill Spence played with his pals on piles of coal waste, oblivious to the toxic heavy metals right under his feet,” writes Forbes’ Chris Helman. “After working as an oil industry engineer out west, he returned home in the 1990s and found the piles—known as ‘gob5,’ for ‘garbage of bituminous’—still pockmarking the landscape. The present worry is that these unlined pits are leaching deadly carcinogens into the groundwater—or, worse, that they will catch fire and start polluting the air, too.”

In 2017, Spence bought control of the Scrubgrass Generating power plant in Venango County, PA — a plant that was specifically designed to combust gob … but there was a problem: gob isn’t very good fuel, and the plant wasn’t profitable. But then, Spence had an inspired idea: he could use the Scrubgrass plant to mine bitcoin, which, even at a price around half of its peak, enables Scrubgrass to realize returns that are multiples higher than the 3 cents per kWh they earn selling to the power grid.

The irony is that, while far from perfect, burning gob seems much cleaner than burning coal. “CFB boilers use relatively low temperatures to combust coal, emitting less nitrogen oxide (NOx) pollutants [than coal],” says the AMR Clearinghouse, a group that works to serve Pennsylvania’s watershed associations. “CFB plants also inject crushed limestone into the boiler, which combines with sulfur in the gob to create an inert solid that is captured to minimize airborne sulfur (SOx) emissions. Using appropriate pollution controls, CFB power plants meet EPA and DEP air quality standards.”

The benefits that Bitcoin mining can bring to the grid and incentives it provides to plants like Scrubgrass to profitably remove harmful pollutants from the ground before they leech into the local water supply should by now, be obvious — but there are more benefits here that are more directly obvious to local communities, and those come in the form of high-paying jobs and increased tax revenue. Recently, Nebraska Public Power District VP, Courtney Dentlinger, testified in a hearing before the US Senate about the “significant benefits” that Bitcoin mining has provided to the state, and she touched on the same reduced energy costs, grid stabilizations, and pollutant mitigation that we touched on, above. Check out her testimony on C-SPAN, below, and let us know if Bitcoin’s environmental redemption arc convinces you in the comments.

Senate Hearing on Cryptocurrency & the Environment

ORIGINAL CONTENT FROM brain+trust PARTNERS; SOURCE LINKS THROUGHOUT.

-

- Mining is the term used for carrying out the actual math to decrypt and verify the ledger of events and transactions, or “blocks,” that are sequentially “chained” together to make up the blockchain. You can learn more about that process here.

- You can read about China’s environmentally-motivated crypto mining ban here.

- The Bitmain Antminer S7 is a low-cost Bitcoin mining option rated highly on several “best miner” lists online. It’s popular primarily because of its lower power consumption, using a 1600W power supply and operating at relatively high efficiency at room temperatures. You can read more about it on this list, where it’s ranked in the number 2 spot, just behind a miner that uses more than 2x the energy.

- Intermittent electricity is at term that refers to any electrical energy that is not continuously available due to external factors that cannot be controlled, or that is produced by electricity generating sources that vary in their conditions on a relatively short time scale. Sources of “intermittent electricity” include solar, wind, tidal, and wave power.

- “Gob piles” are common throughout Pennsylvania’s coal country: huge eyesores with dangerous, unstable slopes. They absorb solar heat to become so hot they cannot support vegetation, and heavy erosion from these piles becomes a source of acid mine drainage, which contains heavy metals and acids that pollute streams and rivers. Besides the environmental degradation, gob piles sink property values and contribute to economic decline in Pennsylvania’s communities. — Abandoned Mine Reclamation Clearinghouse.

- Featured image source link here.